Stock Trading

-

sweetandsour

- Deacon

- Posts: 3779

- Joined: 08 Apr 2022, 03:59

- Has thanked: 481 times

- Been thanked: 471 times

Stock Trading

Sometimes it works that way. If you'd bought last Friday you'd be 10$ up so far.

The Indians will not bother you now, on account of ... you are touched.

- JimVH

- Deacon

- Posts: 4739

- Joined: 08 Apr 2022, 13:47

- Location: I could tell you, but…

- Has thanked: 818 times

- Been thanked: 864 times

Stock Trading

Instead I’m down ten bucks. Boredom and novelty are poor reasons to buysweetandsour wrote: 18 Jul 2024, 04:58Sometimes it works that way. If you'd bought last Friday you'd be 10$ up so far.

-

sweetandsour

- Deacon

- Posts: 3779

- Joined: 08 Apr 2022, 03:59

- Has thanked: 481 times

- Been thanked: 471 times

Stock Trading

I've been chasing NEM this morning with limit buy orders, with the price steadily staying ahead of me. There's a way to do this automatically, I'll try that next. Earnings report this afternoon, so we'll see.

The Indians will not bother you now, on account of ... you are touched.

- Del

- Deacon

- Posts: 4071

- Joined: 11 Apr 2022, 22:08

- Location: Madison, WI

- Has thanked: 394 times

- Been thanked: 618 times

Stock Trading

I got clobbered bad with the downturn of SPX this week. Almost back to square one.

Partly my fault. I was working hard at building our village festival and not minding the market.

An expensive lesson.... If I don't have time to attend to my trades, it's just better to take a week off. If I had a real job, I wouldn't pretend to be working at it while I'm up at the Park every day.

Partly my fault. I was working hard at building our village festival and not minding the market.

An expensive lesson.... If I don't have time to attend to my trades, it's just better to take a week off. If I had a real job, I wouldn't pretend to be working at it while I'm up at the Park every day.

-

sweetandsour

- Deacon

- Posts: 3779

- Joined: 08 Apr 2022, 03:59

- Has thanked: 481 times

- Been thanked: 471 times

Stock Trading

I know the feeling. Sometimes this trading seems like a full time job. I like the very short term day trading where I don't own anything at the end of the day. But still, I got stuck with NEM at the end of the day yesterday, and today it's price dropped with the overall SPX.Del wrote: 25 Jul 2024, 11:11 I got clobbered bad with the downturn of SPX this week. Almost back to square one.

Partly my fault. I was working hard at building our village festival and not minding the market.

An expensive lesson.... If I don't have time to attend to my trades, it's just better to take a week off. If I had a real job, I wouldn't pretend to be working at it while I'm up at the Park every day.

I'm debating now whether to sell my Fidelity Equity Index Fund, while I still can capture some profits.

The Indians will not bother you now, on account of ... you are touched.

- Del

- Deacon

- Posts: 4071

- Joined: 11 Apr 2022, 22:08

- Location: Madison, WI

- Has thanked: 394 times

- Been thanked: 618 times

Stock Trading

Trading is a profitable hobby/job, and I encourage anyone with the time and enthusiasm to learn how to do it. But it comes with a simple rule: If you place an active trade, you have to mind it. If you can't keep an eye on it for the duration of the trade, don't do it.sweetandsour wrote: 25 Jul 2024, 15:29I know the feeling. Sometimes this trading seems like a full time job. I like the very short term day trading where I don't own anything at the end of the day. But still, I got stuck with NEM at the end of the day yesterday, and today it's price dropped with the overall SPX.Del wrote: 25 Jul 2024, 11:11 I got clobbered bad with the downturn of SPX this week. Almost back to square one.

Partly my fault. I was working hard at building our village festival and not minding the market.

An expensive lesson.... If I don't have time to attend to my trades, it's just better to take a week off. If I had a real job, I wouldn't pretend to be working at it while I'm up at the Park every day.

I'm debating now whether to sell my Fidelity Equity Index Fund, while I still can capture some profits.

Some people like to trade very short-term, very active trades. They like to watch the market like a video game.

My weekly trades, I need to check them a few times each day.

Active/passive trades (like your index fund).... A few times per week or per month, depending on your goals and risk tolerance.

My worst loss trades come from either panicking, or by not paying attention. A wise and successful trader walks the narrow path between these.

- Del

- Deacon

- Posts: 4071

- Joined: 11 Apr 2022, 22:08

- Location: Madison, WI

- Has thanked: 394 times

- Been thanked: 618 times

Stock Trading

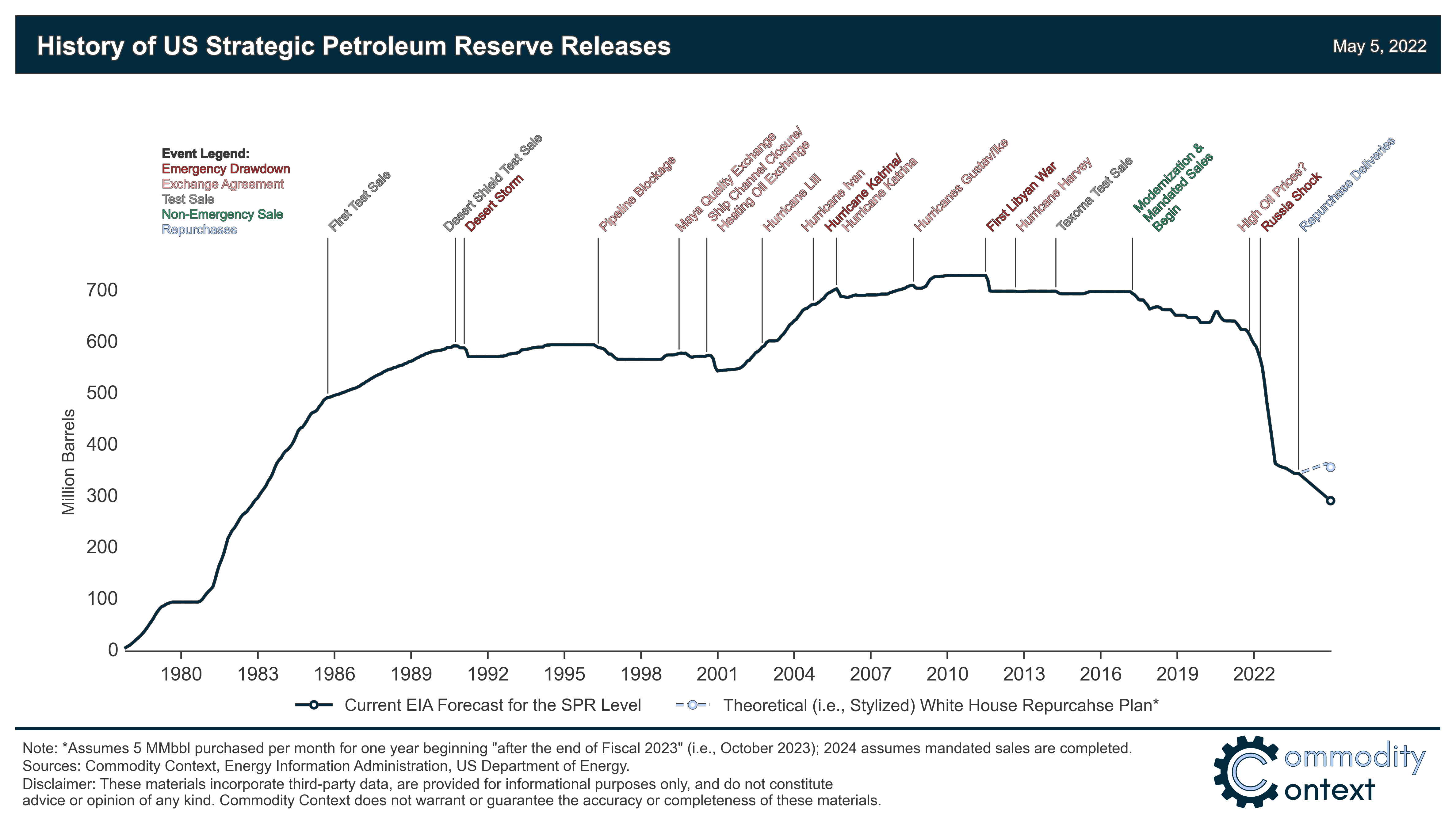

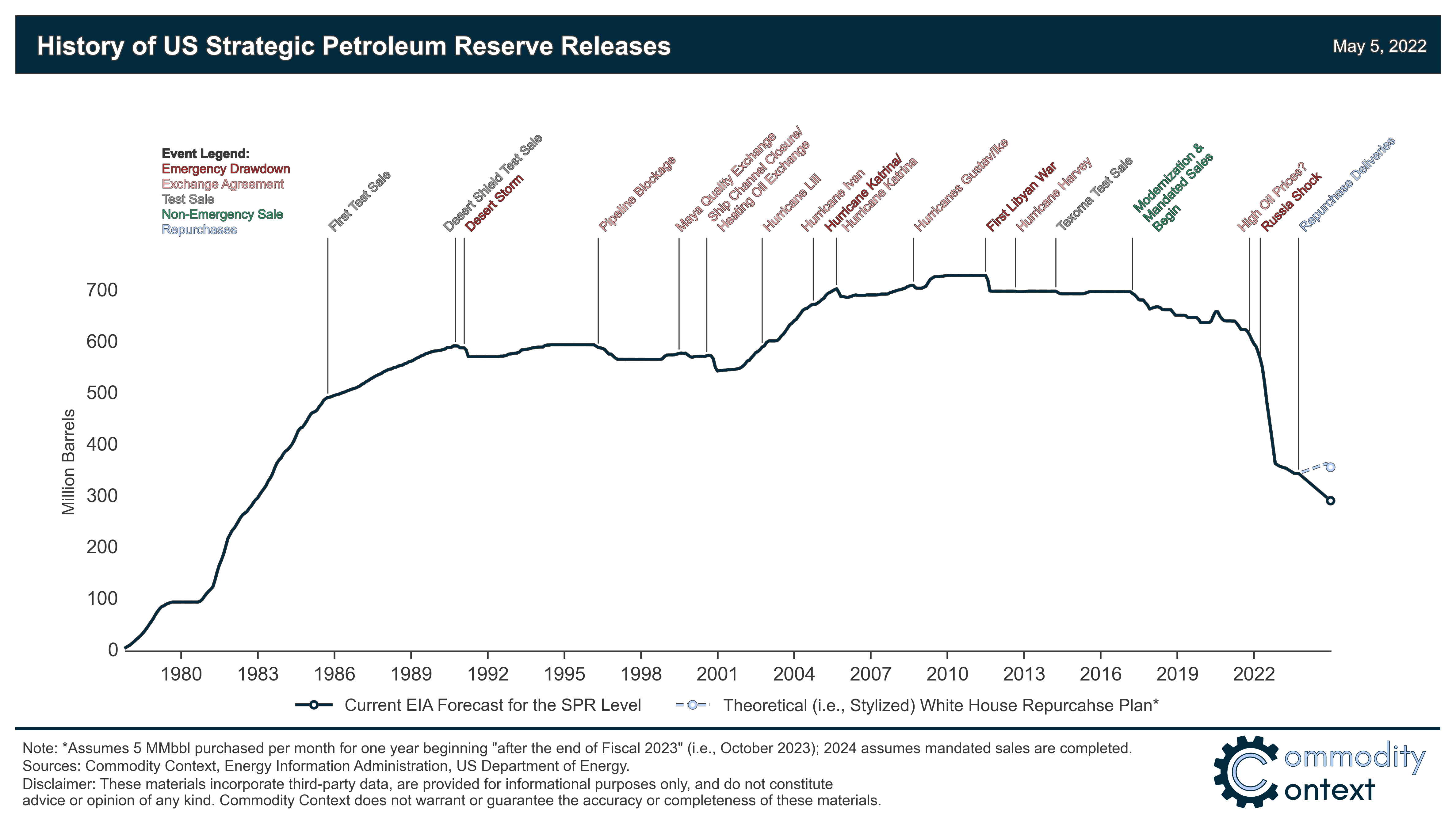

It's been a while since we looked at the Strategic Petroleum Reserve:

This chart was published in May, 2022. I post it because it has historic events and past draw-downs marked.

The starkest thing is that Biden's 2022 mid-term election crisis was greater than all other wars, disasters, and geopolitical turmoil combined.

The projected fork at the end of the chart: Biden had proposed to start buying back some oil into the SPR, starting in October, 2023. I do not know if that plan was put into place.

From this article:

https://www.commoditycontext.com/p/quick-context-spr-20

This chart was published in May, 2022. I post it because it has historic events and past draw-downs marked.

The starkest thing is that Biden's 2022 mid-term election crisis was greater than all other wars, disasters, and geopolitical turmoil combined.

The projected fork at the end of the chart: Biden had proposed to start buying back some oil into the SPR, starting in October, 2023. I do not know if that plan was put into place.

From this article:

https://www.commoditycontext.com/p/quick-context-spr-20

- Del

- Deacon

- Posts: 4071

- Joined: 11 Apr 2022, 22:08

- Location: Madison, WI

- Has thanked: 394 times

- Been thanked: 618 times

Stock Trading

Mr. Market looks like he's about to throw up....

You know how everybody says that you shouldn't run through a crowded theater shouting, "FIRE! FIRE!"???

Well, somebody has been running across the trading floors and shouting "RECESSION!"

==================================

On Wednesday, FED said that inflation is coming down nicely and employment is looking good. This signals that FED is considering lowering rates sooner rather than later. Mr. Market expected this, and all was well.

On Thursday, a leading indicator of the manufacturing sector showed that in July, manufacturers ordered less supplies and hired fewer employees. This is what triggered the whispers of recession.

Before market opened this morning, national employment data dropped. Unemployment is 4.3% -- which is fine, but 0.2% higher than expected. 114K new jobs were created -- about 60K less than expected. This reinforced the recession fears.

Not to mention the specter of President Kamala and more severe policies smashing our economic well-being.

==================================

I need you to swoop in with all the cash you have sidelined and lift the market up for me. Okay?

You know how everybody says that you shouldn't run through a crowded theater shouting, "FIRE! FIRE!"???

Well, somebody has been running across the trading floors and shouting "RECESSION!"

==================================

On Wednesday, FED said that inflation is coming down nicely and employment is looking good. This signals that FED is considering lowering rates sooner rather than later. Mr. Market expected this, and all was well.

On Thursday, a leading indicator of the manufacturing sector showed that in July, manufacturers ordered less supplies and hired fewer employees. This is what triggered the whispers of recession.

Before market opened this morning, national employment data dropped. Unemployment is 4.3% -- which is fine, but 0.2% higher than expected. 114K new jobs were created -- about 60K less than expected. This reinforced the recession fears.

Not to mention the specter of President Kamala and more severe policies smashing our economic well-being.

==================================

I need you to swoop in with all the cash you have sidelined and lift the market up for me. Okay?

Last edited by Del on 02 Aug 2024, 10:06, edited 1 time in total.

-

sweetandsour

- Deacon

- Posts: 3779

- Joined: 08 Apr 2022, 03:59

- Has thanked: 481 times

- Been thanked: 471 times

Stock Trading

Entering correction territory. I sold my few shares of NEM this morning, and contemplating capturing profits on my Fid Eq Index as well, and then watch the volatility from the sideline next week. I'm tempted to buy FTAI below 100 though.Del wrote: 02 Aug 2024, 07:26 Mr. Market looks like he's about the throw up....

You know how everybody says that you shouldn't run through a crowded theater shouting, "FIRE! FIRE!"???

Well, somebody has been running across the trading floors and shouting "RECESSION!"

==================================

On Wednesday, FED said that inflation is coming down nicely and employment is looking good. This signals that FED is considering lowering rates sooner rather than later. Mr. Market expected this, and all was well.

On Thursday, a leading indicator of the manufacturing sector showed that in July, manufacturers ordered less supplies and hired fewer employees. This is what triggered the whispers of recession.

Before market opened this morning, national employment data dropped. Unemployment is 4.3% -- which is fine, but 0.2% higher than expected. 114K new jobs were created -- about 60K less than expected. This reinforced the recession fears.

Not to mention the specter of President Kamala and more severe policies smashing our economic well-being.

==================================

I need you to swoop in with all the cash you have sidelined and lift the market up for me. Okay?

Re Harris, that's all we're going to see and hear about everywhere until November. Was predictable, but still, scary.

The Indians will not bother you now, on account of ... you are touched.