Page 20 of 64

Stock Trading

Posted: 22 Sep 2022, 13:20

by Del

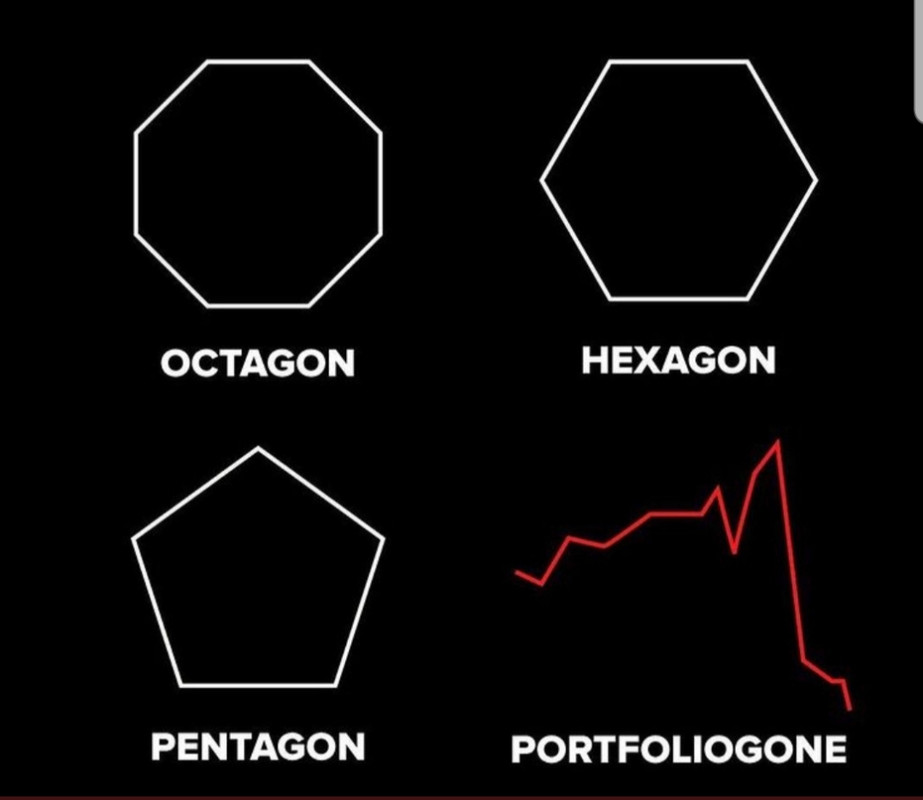

Situation normal, but that's really funny!

Where did you find this?

Stock Trading

Posted: 22 Sep 2022, 14:14

by Jocose

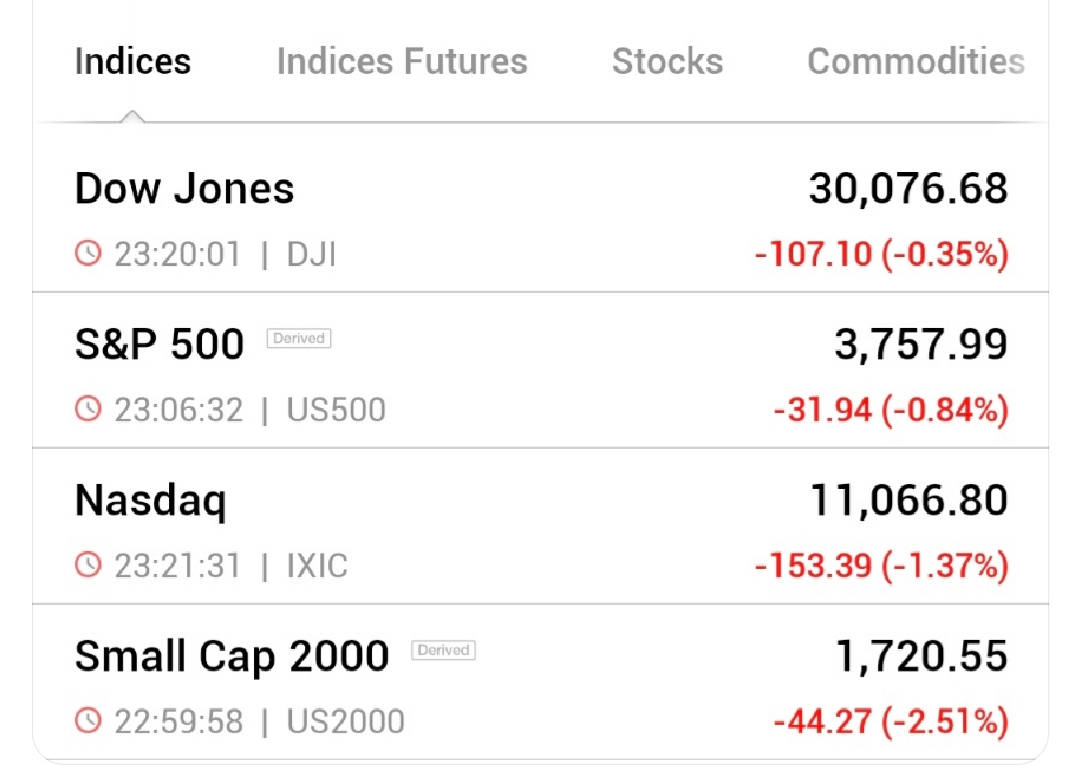

US Stocks end lower for 3rd day in a row as Treasury yields surge.

Stock Trading

Posted: 22 Sep 2022, 14:22

by Jocose

Stock Trading

Posted: 23 Sep 2022, 09:50

by Jocose

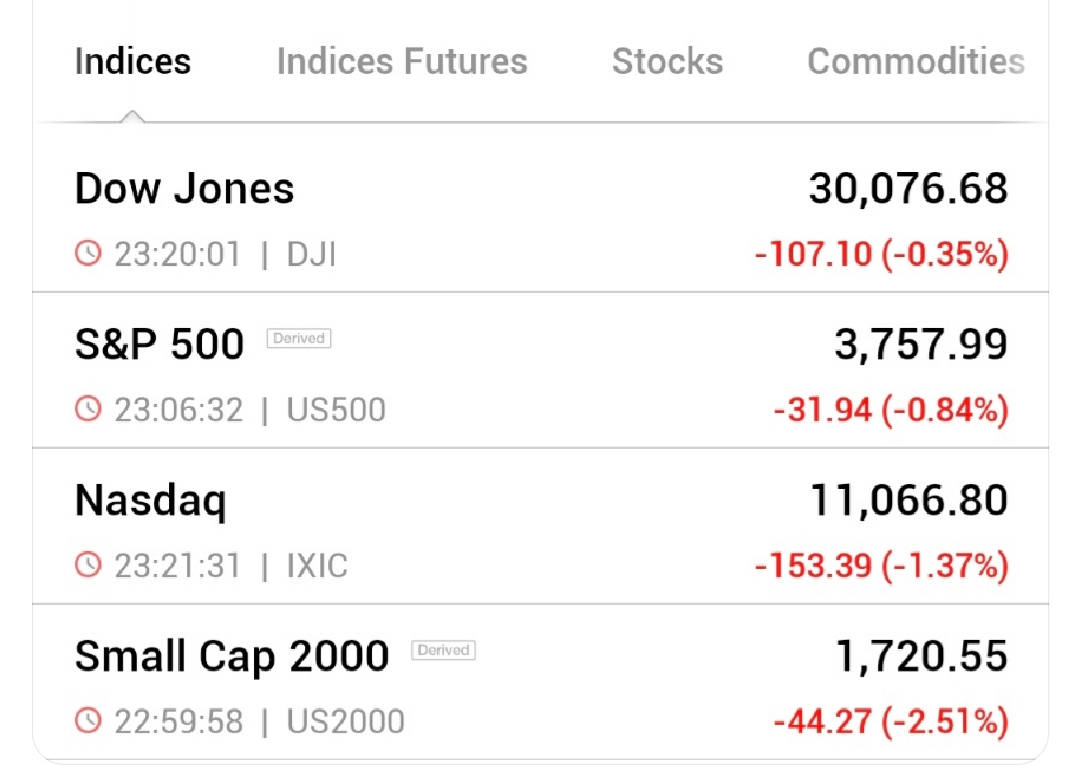

Depression incoming. Brace.

Stock Trading

Posted: 24 Sep 2022, 11:31

by Jocose

Stock Trading

Posted: 27 Sep 2022, 11:14

by Del

The market has fallen off the mattress, smashed through the floor, and is presently considering a tumble down the cellar stairs.

Stock Trading

Posted: 27 Sep 2022, 14:00

by sweetandsour

Del wrote: ↑27 Sep 2022, 11:14

The market has fallen off the mattress, smashed through the floor, and is presently considering a tumble down the cellar stairs.

I'm looking at ~3500. We'll see.

Stock Trading

Posted: 27 Sep 2022, 14:32

by Del

sweetandsour wrote: ↑27 Sep 2022, 14:00

Del wrote: ↑27 Sep 2022, 11:14

The market has fallen off the mattress, smashed through the floor, and is presently considering a tumble down the cellar stairs.

I'm looking at ~3500. We'll see.

Earnings season will knock the market around like a pinball. Everyone will be looking at the "Earnings Guidance" offered as each index member predicts what the coming quarter and year will bring.

3500 will be a sticking point. There was strong resistance there back in Aug - Nov of 2020. It could prove to be the next support.

One analyst predicts the bottom could be in the 3000 to 3400 range. He is guessing at what the earnings projections will be and applying a bear-market price/earnings multiple.

Stock Trading

Posted: 27 Sep 2022, 19:06

by Del

XLE -- Should we hold on to our energy sector position? Or bail and look to buy it back in recovery?

My head is screaming BAIL! BAIL! BAIL!

I can't think of a reason not to listen to myself.

Talk me into it. Or talk me out of it.

Stock Trading

Posted: 27 Sep 2022, 19:23

by sweetandsour

Del wrote: ↑27 Sep 2022, 19:06

XLE -- Should we hold on to our energy sector position? Or bail and look to buy it back in recovery?

My head is screaming BAIL! BAIL! BAIL!

I can't think of a reason not to listen to myself.

Talk me into it. Or talk me out of it.

I was thinking the exact same thing when it was in high 70s, got sidetracked, and then saw it go down 10 dollars. Surely it will bounce back above 70, maybe even 75, and I'll sell it, I've already decided. I don't want to wait for it to rise, which I think it will by the end of the year, and I don't care too much about the 4% dividend, which I think the record date was 9/20. I'll sell XLE now and use the funds for SPY at some point, 350 or lower. Or else day trade.

Edit: BTW, I read today that there was (is?) a very high "outflow" of XLE. I haven't yet learned if this is a good thing, bad thing, or no thing.